Furnished and un furnished accommodation are governed by different rules: lease, deposit and departure notice are different.The same goes for taxation in particular.What are the differences between the two types of rental?What does this change for tenants and owners?

Summary :

To avoid a headache by looking for documents adapted to the accommodation you want to rent, here is a summary of the large differences between a furnished and not furnished accommodation.

| Situation | Logement nu | Logement meublé |

|---|---|---|

| Bail | 3 ans | 1 mois 9 mois si le locataire est étudiant |

| Caution | 1 mois maximum | 2 mois maximum |

| Préavis pour le propriétaire | 6 mois minimum | 3 mois minimum |

| Préavis pour le locataire | 3 mois minimum 1 mois minimum dans les zones très tendues | 1 mois minimum |

| Fiscalité | Les revenus locatifs sont considérés comme des revenus fonciers | Les revenus locatifs dépendent du régime des Bénéfices Industriels et Commerciaux (BIC) |

You can also use rental kits directly suitable for your type of accommodation!They contain all the necessary documents to rent your property.These certified documents are completely free and downloadable from your computer.

Unwavered accommodation: definition and specificities

Unwelcome or naked accommodation are not simply rented accommodation without furniture.Lease, deposit, notice: they obey certain specificities.

Housing is a leased accommodation without furniture, it is therefore up to the tenant to equip his home.However, the owner free to equip the apartment with a minimum of elements.Also, it is not uncommon to find non-mixed accommodation with an equipped kitchen, fridge included.In this case, it will be necessary to think about specifying it in the inventory of entry.

Certain elements of the lease, the deposit or the starting notice are specific to uncommon accommodation.

The lease of an empty accommodation has been regulated since the vote of the Alur law in 2014.The duration of the lease contract for bare accommodation is:

This duration can be reduced for professional or family reasons, without however being less than one year.It will then be necessary to indicate the reason for this reduction in the lease contract.

As the naked accommodation is rented with fewer elements provided by the owner, the potential of the damage is limited for the lessor.It is therefore logical that the deposit, or rather the deposit of guarantee as it is formally called, is therefore less important than in the case of furnished accommodation. La montant peut ainsi pas excéderun mois de loyerhors charges.

It will be returned within a month if no degradation is noted during the inventory of exit, two months otherwise.

On the other hand, the notice period of departure of a non-mixed rental is higher in the case of non-Meublées. Si le locataire souhaite quitter son logement nu, il est dans l'obligation de prévenir son propriétairetrois moisavant le départ prévu.

Cependant, ce délai peut être réduit à1 moisdans les cas suivants :

Pour le bailleur, le délai de préavis est de6 mois.He must also offer for sale his property to his tenant first because he has a pre -emptive right guaranteed by law.

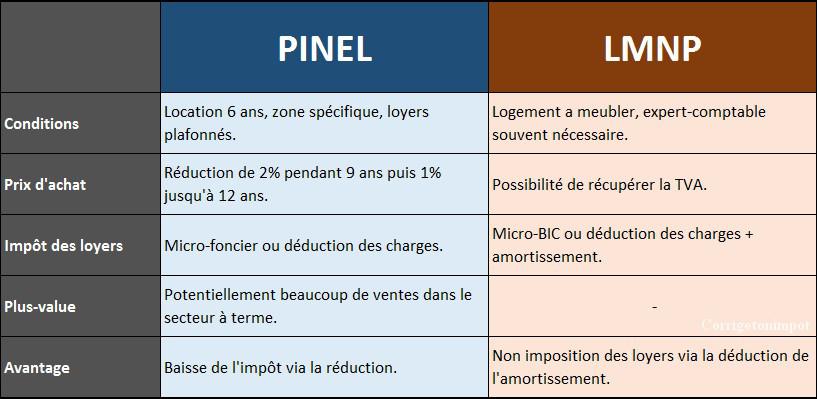

Within the framework of the Pinel law, owners of praised real estate naked can benefit from a tax reduction for 6, 9 or 12 years.

Revenues from non-messed up rentals are considered to be land revenues.Below 15,000 euros per year, they enter the micro-foncier regime. Le bailleur bénéficie alors d'unabattement forfaitaire de 30%.

For income above 15,000 euros, the real regime rule applies: net income is taxable and calculated after deduction of charges.However, donors whose rental income is less than 15,000 euros can also benefit from the real regime if deductible expenses are greater than the lump sum reduction.

Furnished accommodation: definition and specificities

Very logically, furnished accommodation is accommodation with furniture.However, it is not enough for the owner to buy a coffee table and a carpet to make your naked accommodation furnished accommodation.Since September 1, 2015, the criteria have been defined by regulations and furnished accommodation must thus understand:

The furnished furnishedings are not governed by the same rules as the unwelcome housing concerning the lease, the deposit and the departure notice.

Since the ALUR law, the leases for furnished accommodation are subject to a regulated model.There are two types of leases for furnished:

How the owner has the walls and furniture of the accommodation, it seems normal that the warranty deposit is greater than for non-furnished accommodation. Cependant, son montant ne peut pas dépasser les2 mois de loyer hors charges.This threshold has been set by law since 2014.

If the inventory does not indicate any breach, the deposit must be rendered in the month following the departure of the locator and the delivery of the keys.In the event of delay, the lessor will have to pay 10% of the rent for each month behind.

En revanche, le préavis pour un meublé n'est que d'un moispour les locataires.This period is short enough so that there are no possibilities to reduce it further.

Le préavis pour le propriétaire - qui souhaiterait vendre par exemple, est detrois mois.Unlike naked rentals, the tenant has no right to pre -emptive on furnished accommodation.In other words, the lessor does not have to offer his property for sale to his tenant first.

Income from furnished accommodation is not considered to be property income.The tax administration considers that they fall under the rules of industrial and commercial profits.It is therefore possible to deduct most of the charges paid, such as the costs of acquiring real estate or accounting costs.The rental income of a furnished furnished is much more advantageous than if they were considered to be property income.

Can we transform a bare rental in furnished rental? It is possible to transform naked accommodation into furnished accommodation.However, in some cases, it is necessary to request an administrative authorization.This is the case, if it is a seasonal rental or that the apartment is located in a municipality of more than 200,000 inhabitants or if the town hall requires it.This authorization can be limited or provisional.

The law allows more flexibility for furnished.If the basic setting is more important for the tenant, who must pay two months of deposit, the starting notice is much shorter.This allows greater freedom of moving.For the lessor, renting a furnished furnished is also more comfortable on certain points, such as taxation which is more advantageous.He may sometimes not have to pay taxes on his rental income for years.

Fewer and fewer differences between nudes and furnished with the Alur law

The Alur law, promulgated in 2014, reduced the differences between naked and furnished.The list of reasons which put the starting notice of starting from three to a month to lengthen.Among the reasons previously mentioned, living in a very tense area, being with disabilities or having been awarded social housing are additions to the ALUR law.

Home insurance is compulsory whatever the type of housing.For tenants, it is compulsory to ensure your accommodation, whether it is a nude or a furnished.On the other hand, insurance is not compulsory for donors, but it remains highly recommended.

Special features of renting semi -furnished accommodation

Renting a semi-capacity accommodation is possible...in Canada.In France, there are no in-between between bare accommodation and furnished accommodation.Housing rented with some furniture but not enough to be considered a furnished is considered naked.In Canada, on the other hand, a semi-man-man accommodation is housing including basic household appliances.